LATEST UPDATE ON MALAYSIA GST Effective. From 1 st September 2018 Malaysia Airlines will not be issuing a Tax Invoice to passengers as no input tax credits may be claimed.

Dianna Agron Looks Lovely In Louis Vuitton For Harper S Bazaar Malaysia Dianna Agron Glam Looks Model

On August 16 2022 the Board of Governors of the Federal Reserve System Federal Reserve issued guidance for banking organizations engaging or seeking to engage in crypto-asset-related activities August 2022 Guidance.

. Reduced Late fee 42018. 100GST will be charged with any add-onJodi connections or additional free SIM with any other name already given with postpaid plans except the free family connections given with Plan 5257989991525. The New Funding Landscape Supply Chain Opportunities.

In the 2017-18 financial year ie. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Easy and Fast Thanks for the Help Very Nice Services will contact for other services too.

Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime. 1 April 2017 to 31 March 2018 the IRS IT received 58713458 returns and collected direct taxes amounting to 1137 Lakh Crores equivalent to 11370 Billions spending 6 equivalent to 800 or 10 US in 2020 for every 1000 equivalent to 1300 or US16 in 2020 it collected. See information about unclaimed refunds for details.

The reintroduction of the Sales and Services Tax SST has kept corporates across Malaysia busy for the last three months or so. There are no exceptions to this rule except when using a. These provisions are aimed to strike a balance in the society and to achieve the ultimate ends of justice.

Segala maklumat sedia ada adalah untuk rujukan sahaja. For all other back taxes or previous tax years its too late. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

Unfortunately if you owe taxes there is no time limit. SAC Code. The value of the goods including freight and insurance fees help customs to determine the duties and taxes and to clear your shipment.

Reducing the cost of doing business. HSN Code List for GST Download HSN SAC Code List in Excel PDF Format. This is only if you expect.

For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. Legal Provisions of Order VI of Code of Civil Procedure 1908 CPC India Pleadings Generally. When the said items are exported to Countries like Singapore Malaysia United States Australia and United Kingdom.

The HS code is used to classify the product type. Effective July 16 2018 the Sales and Services. Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə.

Amendment in the Provisions of HSN under GST. Here are the details of Late Fees and Interest under GST. From outside the local area dial the full area code followed by the phone number.

This declaration of HSN Code shall be made irrespective of the Turnover. The Code of Civil Procedure lays down the fundamental rules of pleadings along with the amendments to the same. HSN Code.

Can I get the List with New Rates updated on 18th January 2018 in a one Excelpdf file. November 12 2018 More Reversal of JustOne Savings Account Bonus Interest Effective. In the run-up to Budget 2018 our Head of Indirect Tax Raja Kumaran discusses the need for a more resilient and sustainable GST system in Malaysia.

Youre not purchasing Facebook ads for a business purpose or your business isnt GST registered we add GST at the applicable local tax rate to the cost of your Facebook ad purchase. Straight2Bank Purpose of Payment Code Effective. Customer Service Professional of the Year 2018 Service Champion for Service Excellence in a Small Contact Centre 2018 Service Champion for Customer.

From 1 st June 2018 until 31 st August 2018 PSC is subject to GST rate 0. According to the GST legislation a late fee is an amount imposed for late filing of GST returns. Beginning August 1 2018 if the Sold By entity on the receipt of your Facebook ad purchase is outside of Australia and the Sold To address we have for you is in Australia.

To call a Malaysian number. Information on GST return late fees is mentioned. Waived off completely 752018.

This article will help you learn GST invoice format in Word PDF and Excel and how QuickBooks Online can help you generate GST ready invoices within no time. Check GST HSN Code. From overseas dial the international access code the country code for Malaysia the area code without the 0 and then the phone number.

CTIM NATIONAL GST CONFERENCE 2018 - 27 28 February. July 2017 September 2018. 782020- Central Tax dated 15102020 the CBIC announced that wef 01042021 It would be mandatory to declare the HSN Code on the TAX Invoices of Goods and Services.

The Malaysia Customs Department determine the amount of import duties and taxes based on several factors. For some of the items it should be no. The Authority for Advance Ruling under GST Maharashtra in the case of Basf India Limited- 2018-TIOL-82-AAR-GST dated 21st May 2018 has held that goods sold on HSS by the HSS seller is a supply which is not taxable under GST ie non.

The country code for Malaysia is 60. Effective from 1 st September 2018 the PSC will be not be subject to ST. The e-ticket will be the commercial invoice under.

October 25 2018. November 1 2018. June 1 2018.

November 5 2018 More Change of Maxis Broadband Maxis payment service Effective.

Annual Reports Proxy Information

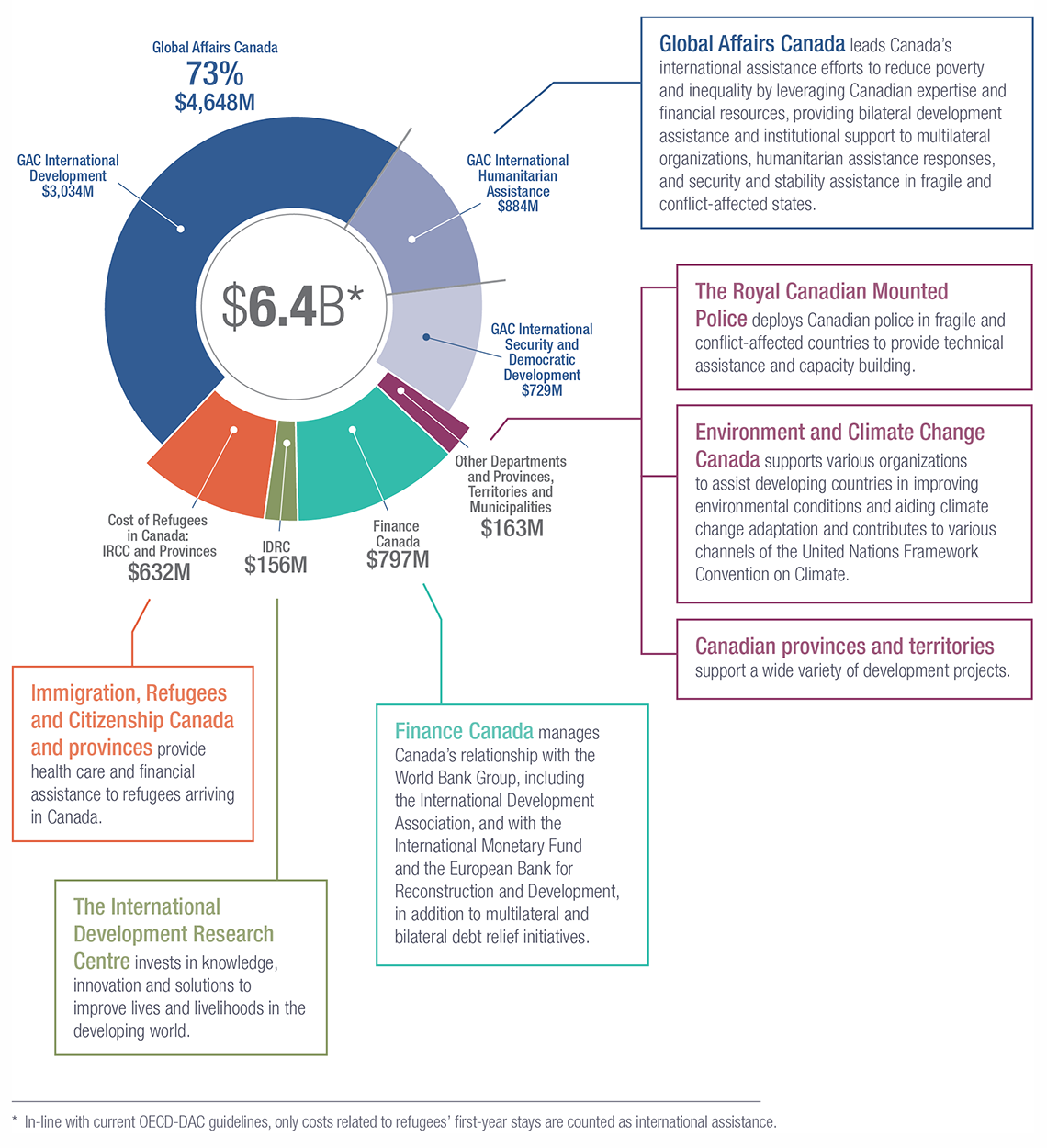

Statistical Report On International Assistance 2018 2019

National University Sudan Nusu Home Facebook

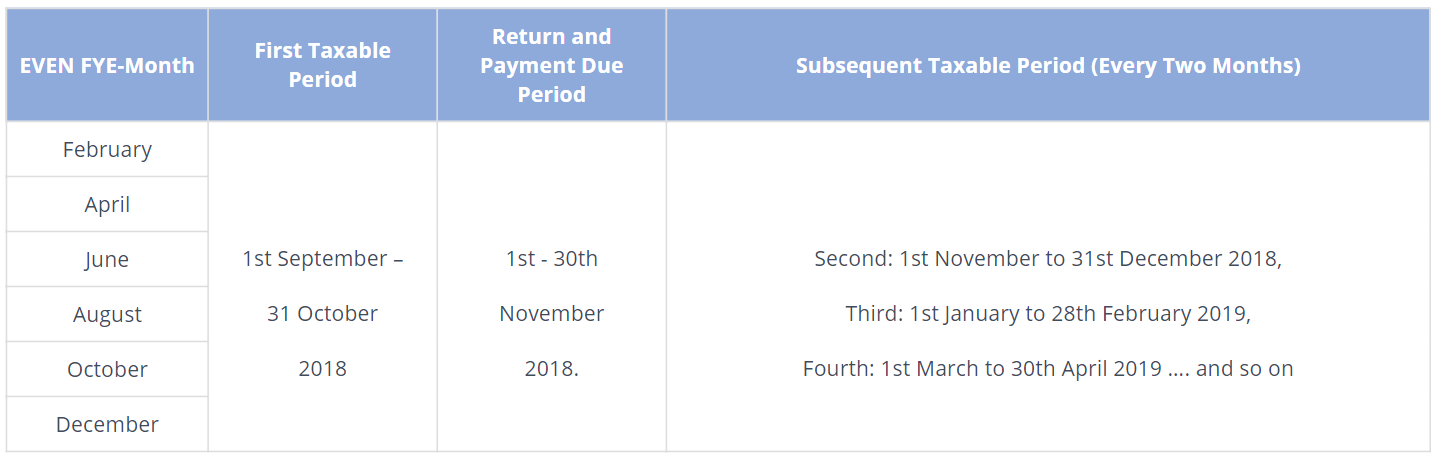

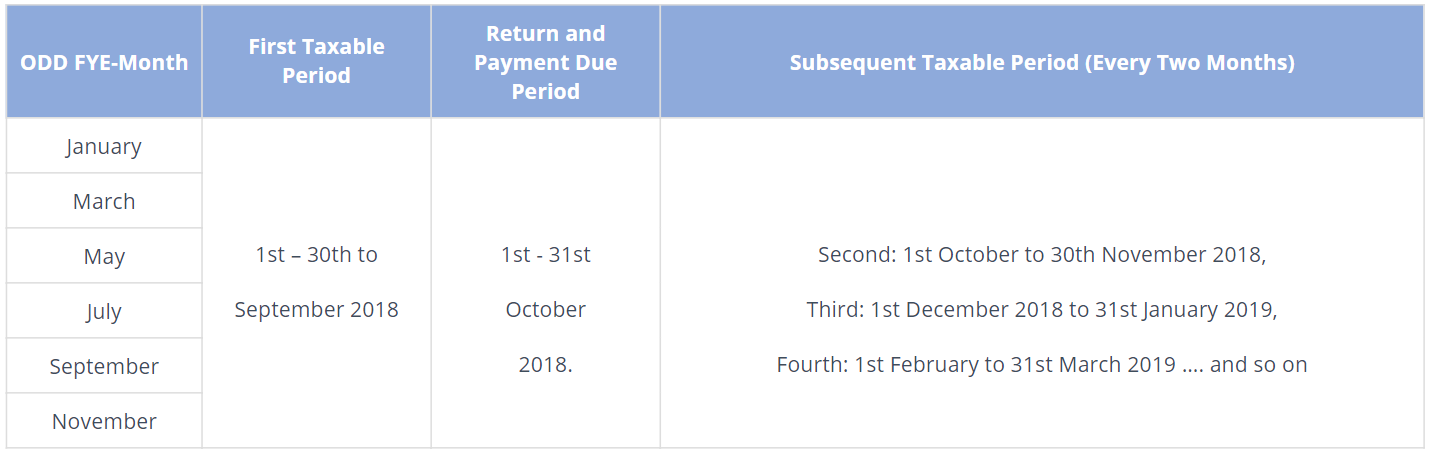

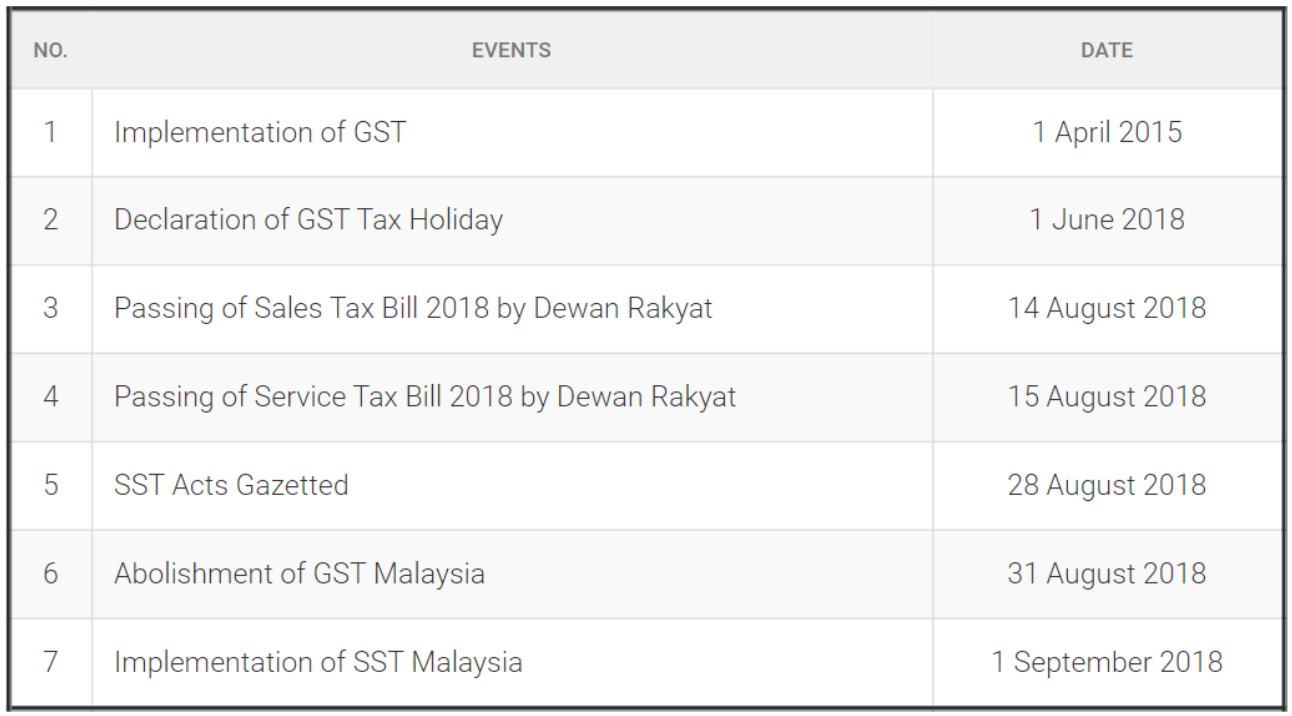

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Statistical Report On International Assistance 2018 2019

Malaysia Sst Sales And Service Tax A Complete Guide

F1 Shirtf1 Shirt Corporate Shirts Corporate Uniforms Shirts

Malaysia Sst Sales And Service Tax A Complete Guide

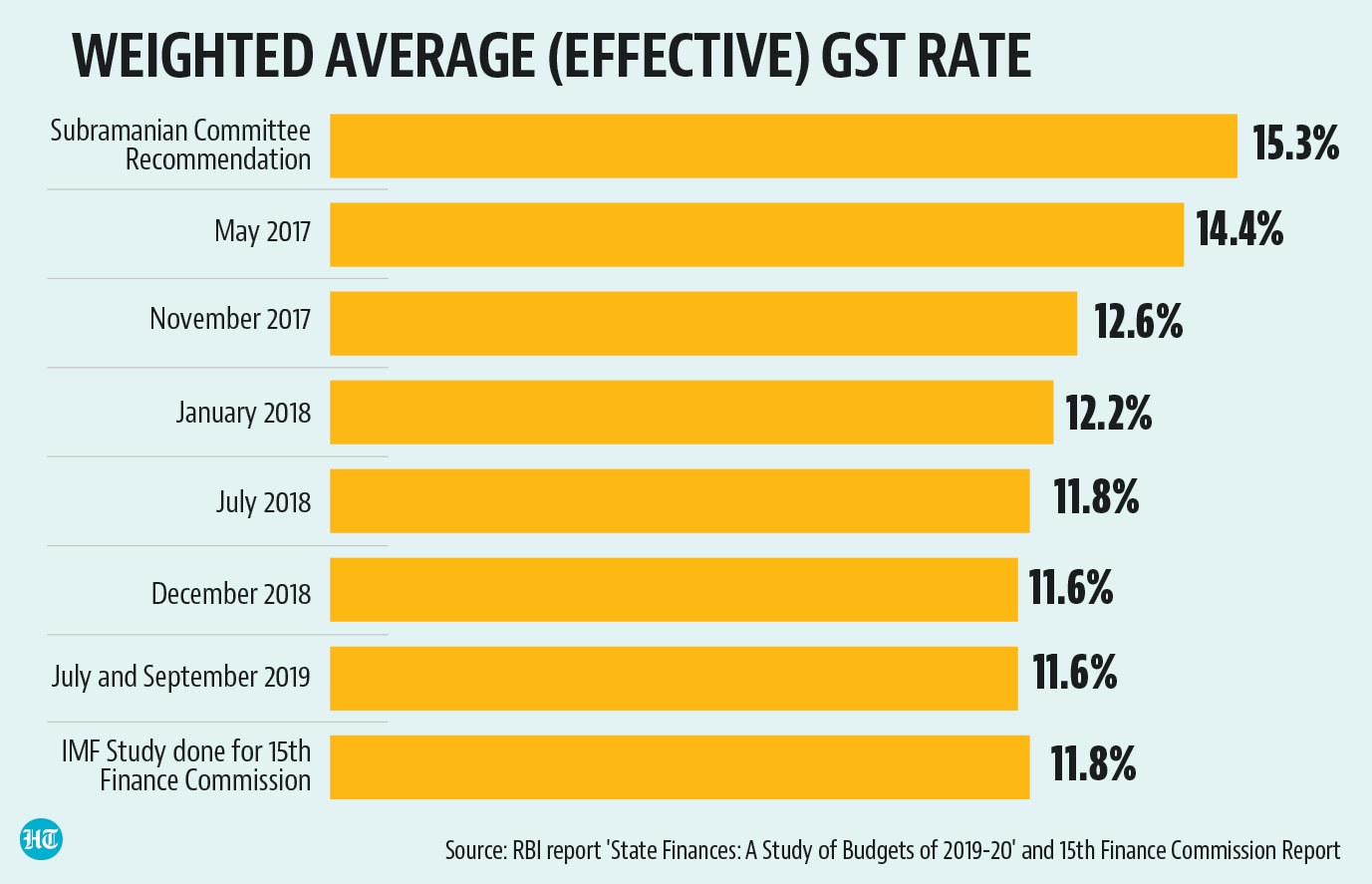

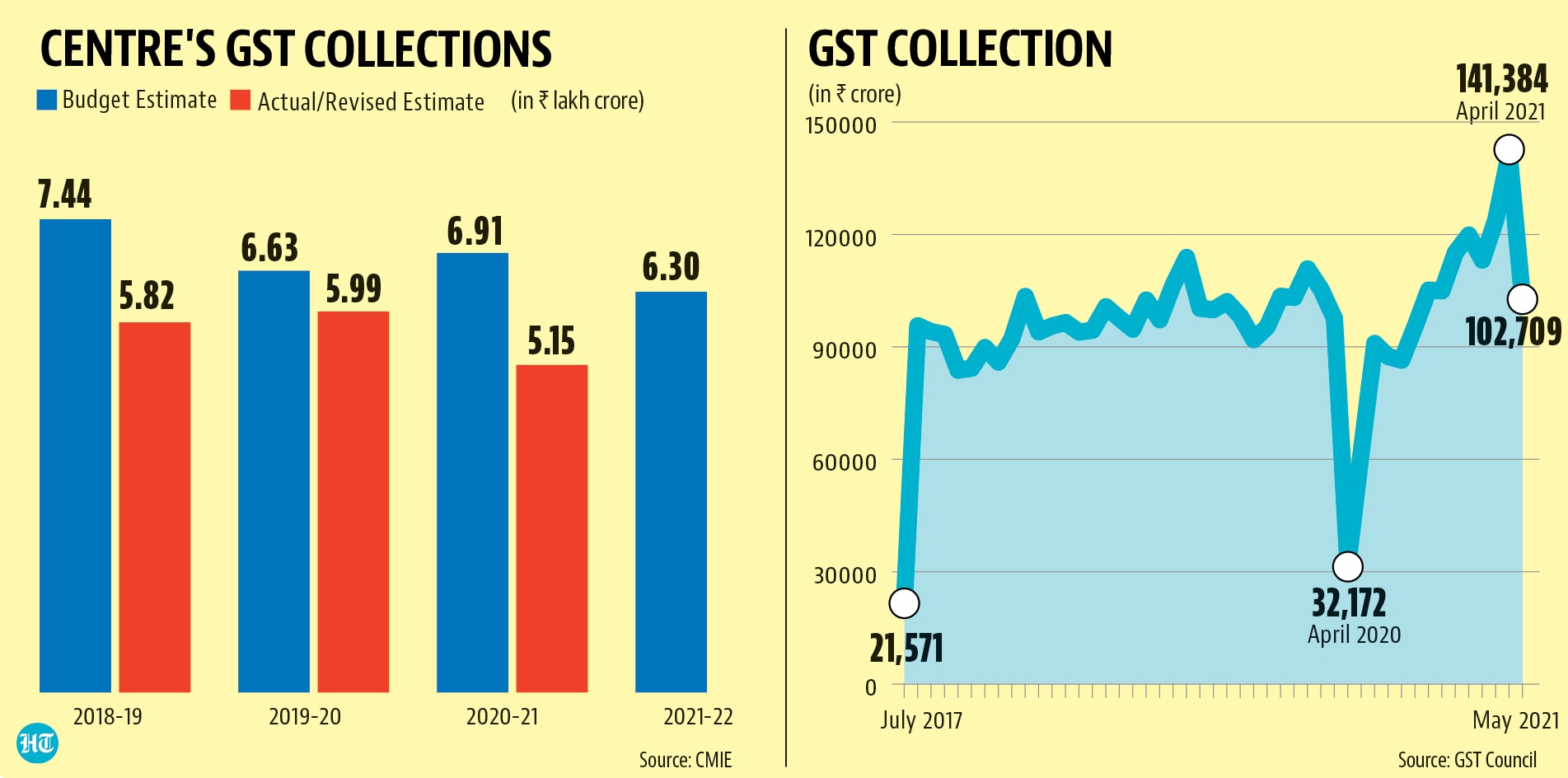

Four Years Of Gst Success Or Not Quite Hindustan Times

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Malaysia Sst Sales And Service Tax A Complete Guide

Battle Royale On Social Media In The 2018 General Election In Malaysia Sani 2018 Asian Politics Amp Policy Wiley Online Library

Buy Online Cream And Peach Embroidered Suit Sku Code Khoj2560 At Khojkala Design Party Wear Salwar Kameez Designs

Intel 2020s Process Technology Roadmap 10nm 3nm 2nm And 1 4nm For 2029 Technology Roadmap Roadmap Design Rules

What Is Your Hs Code Tariff Business Advisory Services Facebook

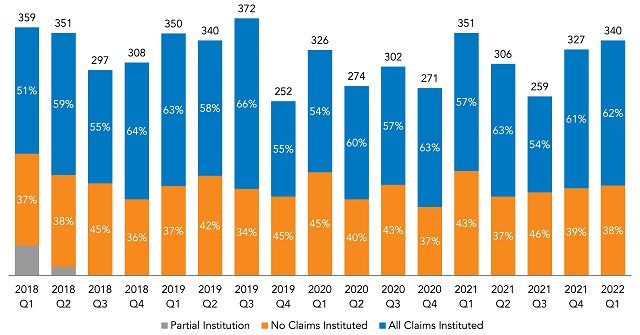

Q1 In Review Courts Tackle Sep Issues As Patent Deals And Third Party Funding Bolster Npe Activity Patent United States

Four Years Of Gst Success Or Not Quite Hindustan Times